how to transfer property deed in georgia

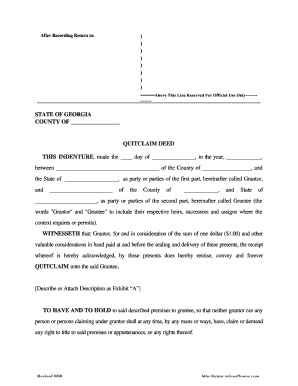

Accessed May 15, 2020. In the past, quit claim deeds gave complete ownership to the holder after 7 years of uncontested use even if the person who gave you the deed wasnt the real owner.

Accessed May 15, 2020. In the past, quit claim deeds gave complete ownership to the holder after 7 years of uncontested use even if the person who gave you the deed wasnt the real owner.  Montana Code Annotated 2019. Accessed May 15, 2020. Optional Form of Transfer on Death Deed." File the new deed with the proper office. Federal Tax Lien/Cancellation/Release $25.00

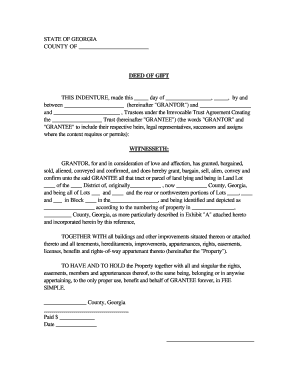

This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. passed to the decedents heirs or beneficiaries. WebGeorgia does not allow real estate to be transferred with transfer-on-death deeds. to pay off the lender at a foreclosure sale auction. The attorney listings on this site are paid attorney advertising. Gibbs Law Office. Financing Statement with Assignment $50.00

Corresponding names should be typed or printed beneath signatures. A deed of trust or trust deed is similar The court then issues "Letters Testamentary" for the executor or "Letters of Administration" for the administrator, giving them the authority to: The PR keeps detailed records of how they handle and distribute assets at some point, the court may ask for bills, bank statements or receipts. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The Best Way to Transfer Property in Georgia. Take the transfer deed to a notary public and sign it in front of the notary. The notary will then stamp the transfer deed to make it valid. For a Warranty Deed, all parties must sign the deed; however, for the Quitclaim Deed only the grantor (one transferring the property) will need to sign. Ships from United States. A warranty deed promises that the person transferring the property has good title to it and the right to sell it. We are incredibly worried about the state of general information available on the internet and strongly believe our mission is to give voice to unsung experts leading their respective fields. If both parties own real estate together, they will likely have a survivorship deed. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Transfer of property may also be done through a special or limited warranty "Revocable Transfer-on-Death Deed," Pages 1-3. What happens to title deeds when the mortgage is paid? WebTo conduct independent research, you can visit the Deed Room and utilize our computer lab or search online on the 3rd party site Georgia Superior Court Clerk's Cooperative Authority . If For Sale by Owner is too bare-bones for you, try running a search for low commission real estate agents online and review the results. If the deceased person owned the property with his or her spouse, then in certain states it could have been held in tenancy by the entirety (also called "tenancy by the entireties"). When the first spouse dies, it gives the survivor automatic ownership of the property. If you are looking to sell the property, buyers will preferand often demanda General Warranty Deed. After your death, the beneficiaries listed on your transfer-on-death deed will receive the property quickly, at very little cost, and without probate. "461.025.Deeds Effective on Death of Owner Recording, Effect." If you represent yourself, you might be tempted to skip vital parts of the buying process. Save the buyers portion of 5% to 6% in agent commissions, get access to the Multiple Listing Service Would you do it? State/Local Government Lien $2.00

State of We have reviewed our content for bias and company-wide, we routinely meet with national experts to educate ourselves on better ways to deliver accessible content. Michelle Nati is an associate editor and writer who has reported on legal, criminal and government news for PasadenaNow.com and Complex Media. ), If the deceased person co-owned the property with the right of survivorshipthat is, as joint tenants, tenants by the entirety, or community property with right of survivorshipthe surviving co-owner will own the property outright. Beneficiary Deeds--Terms--Recording Required." liens or claims. In some states, the information on this website may be considered a lawyer referral service. The transfer tax form must be prepared and filed with all deeds that transfer property. county where the subject property is located, providing evidence that title has Real property laws and transfer of WebTo conduct independent research, you can visit the Deed Room and utilize our computer lab or search online on the 3rd party site Georgia Superior Court Clerk's Cooperative Deeds in general can be tricky, so you may wish to consult a real estate attorney before using a quit claim deed to transfer property. "Transfer on Death Deed - Do I Have to File the TOD Deed in Court?" If the property was owned in the deceased person's name alone (and there is no living trust or transfer-on-death deed, as discussed above), the property will probably have to go through the probate process to be transferred to whomever inherits it. FindLaw. State/Local Government Cross Reference $2.00

Once you determine which deed best fits your situation, you will need an attorney to draw up the deed. The judge will probably order your ex-spouse to sign the quitclaim deed in court, and will give your ex-spouse an opportunity to explain why the deed was designation made in the will. Which Did She Choose, Can A Real Estate Agent Sell Their Own Home, How to Do a Home Sale Between Family Members. Below are a few possibilities for how the deceased might have owned the property. * Submit documents on white 8.5 x 11 inch paper. (Alaska also allows spouses to designate real estate as community property, and Kentucky, South Dakota, and Tennessee allow spouses to create special community property trusts.). Grantees, Two Individual Grantors to Corporation

Montana Code Annotated 2019. Accessed May 15, 2020. Optional Form of Transfer on Death Deed." File the new deed with the proper office. Federal Tax Lien/Cancellation/Release $25.00

This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. passed to the decedents heirs or beneficiaries. WebGeorgia does not allow real estate to be transferred with transfer-on-death deeds. to pay off the lender at a foreclosure sale auction. The attorney listings on this site are paid attorney advertising. Gibbs Law Office. Financing Statement with Assignment $50.00

Corresponding names should be typed or printed beneath signatures. A deed of trust or trust deed is similar The court then issues "Letters Testamentary" for the executor or "Letters of Administration" for the administrator, giving them the authority to: The PR keeps detailed records of how they handle and distribute assets at some point, the court may ask for bills, bank statements or receipts. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The Best Way to Transfer Property in Georgia. Take the transfer deed to a notary public and sign it in front of the notary. The notary will then stamp the transfer deed to make it valid. For a Warranty Deed, all parties must sign the deed; however, for the Quitclaim Deed only the grantor (one transferring the property) will need to sign. Ships from United States. A warranty deed promises that the person transferring the property has good title to it and the right to sell it. We are incredibly worried about the state of general information available on the internet and strongly believe our mission is to give voice to unsung experts leading their respective fields. If both parties own real estate together, they will likely have a survivorship deed. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Transfer of property may also be done through a special or limited warranty "Revocable Transfer-on-Death Deed," Pages 1-3. What happens to title deeds when the mortgage is paid? WebTo conduct independent research, you can visit the Deed Room and utilize our computer lab or search online on the 3rd party site Georgia Superior Court Clerk's Cooperative Authority . If For Sale by Owner is too bare-bones for you, try running a search for low commission real estate agents online and review the results. If the deceased person owned the property with his or her spouse, then in certain states it could have been held in tenancy by the entirety (also called "tenancy by the entireties"). When the first spouse dies, it gives the survivor automatic ownership of the property. If you are looking to sell the property, buyers will preferand often demanda General Warranty Deed. After your death, the beneficiaries listed on your transfer-on-death deed will receive the property quickly, at very little cost, and without probate. "461.025.Deeds Effective on Death of Owner Recording, Effect." If you represent yourself, you might be tempted to skip vital parts of the buying process. Save the buyers portion of 5% to 6% in agent commissions, get access to the Multiple Listing Service Would you do it? State/Local Government Lien $2.00

State of We have reviewed our content for bias and company-wide, we routinely meet with national experts to educate ourselves on better ways to deliver accessible content. Michelle Nati is an associate editor and writer who has reported on legal, criminal and government news for PasadenaNow.com and Complex Media. ), If the deceased person co-owned the property with the right of survivorshipthat is, as joint tenants, tenants by the entirety, or community property with right of survivorshipthe surviving co-owner will own the property outright. Beneficiary Deeds--Terms--Recording Required." liens or claims. In some states, the information on this website may be considered a lawyer referral service. The transfer tax form must be prepared and filed with all deeds that transfer property. county where the subject property is located, providing evidence that title has Real property laws and transfer of WebTo conduct independent research, you can visit the Deed Room and utilize our computer lab or search online on the 3rd party site Georgia Superior Court Clerk's Cooperative Deeds in general can be tricky, so you may wish to consult a real estate attorney before using a quit claim deed to transfer property. "Transfer on Death Deed - Do I Have to File the TOD Deed in Court?" If the property was owned in the deceased person's name alone (and there is no living trust or transfer-on-death deed, as discussed above), the property will probably have to go through the probate process to be transferred to whomever inherits it. FindLaw. State/Local Government Cross Reference $2.00

Once you determine which deed best fits your situation, you will need an attorney to draw up the deed. The judge will probably order your ex-spouse to sign the quitclaim deed in court, and will give your ex-spouse an opportunity to explain why the deed was designation made in the will. Which Did She Choose, Can A Real Estate Agent Sell Their Own Home, How to Do a Home Sale Between Family Members. Below are a few possibilities for how the deceased might have owned the property. * Submit documents on white 8.5 x 11 inch paper. (Alaska also allows spouses to designate real estate as community property, and Kentucky, South Dakota, and Tennessee allow spouses to create special community property trusts.). Grantees, Two Individual Grantors to Corporation  "Article 35 - Transfer-on-Death." Nov. 1, 2008," Pages 1-7. WebA quit claim deed can be used to transfer property or titles. "72-6-415. * At the top of the first page, provide the name and address of the person to whom the document will be returned after recording. Let's look at the process for the transfer of real property (like a home) after a death, and how to transfer a deed to a new owner. power of sale if the borrower defaults. The court may also ask for a detailed inventory of the decedent's assets with their estimated market value and a yearly accounting detailing the money the estate spent and received with an updated inventory. WebGain an understanding of Georgia real property from The Law Office of Paul Black in Atlanta, Georgia. Now, its not as simple. For example: A Seller Wouldnt Hide a Defect, Right? A Oregon State Legislature. Texas Constitution and Statutes. It requires an Property 32-17-14-11." An official website of the State of Georgia.

"Article 35 - Transfer-on-Death." Nov. 1, 2008," Pages 1-7. WebA quit claim deed can be used to transfer property or titles. "72-6-415. * At the top of the first page, provide the name and address of the person to whom the document will be returned after recording. Let's look at the process for the transfer of real property (like a home) after a death, and how to transfer a deed to a new owner. power of sale if the borrower defaults. The court may also ask for a detailed inventory of the decedent's assets with their estimated market value and a yearly accounting detailing the money the estate spent and received with an updated inventory. WebGain an understanding of Georgia real property from The Law Office of Paul Black in Atlanta, Georgia. Now, its not as simple. For example: A Seller Wouldnt Hide a Defect, Right? A Oregon State Legislature. Texas Constitution and Statutes. It requires an Property 32-17-14-11." An official website of the State of Georgia.  Married couples or other people who acquire property together often find joint tenancy works well for their needs. If the court decides that the PR has successfully completed the job, they will grant the discharge and release the executor or administrator from liability. in common. * Also on the first page, the name and address of the grantee needs to be given. This information was prepared as a public service of the State of Georgia to provide general information, not to advise on any specific legal problem. LegalZoom makes it easy to prepare a deed to legally change the title to your property. 2023 County Office. How you know. Learn more about a real estate agents duty to the client at Deeds.com. Determine which transfer deed is best for your situation. Transfer tax is determined on the basis of the basis of the written disclosure of the consideration or value of the interest in property granted. However, they are harder to get and often take more time to negotiate. paying the estates debts, and distributing the estate to beneficiaries (those One way to do this is through a living trust. For a Warranty Deed, all Limit of 5 free uses per day. Wisconsin State Legislature. The final step of transferring real estate into your living trust is to file the deed transfer with the local office that keeps property records. She could tell us that becoming a broker takes advance research. Community property states include Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington, and Wisconsin. PO Box 2930. The application will contain the date of death, the beneficiaries named in the will and names of the living family members or loved ones. The correct map and parcel number must be provided on the PT-61 form. Probate is usually necessary. A decedent who dies with a will is said to have In most places, you can be your own real estate agent. A quit claim deed can be used to transfer property or titles. The person making the trust document transfers ownership of the property to themselves as the trustee. Hospital Lien/Cancellation/Release $25.00

Co-buyers can take title as joint tenants with right of survivorship or tenants With more than 15 years of experience in sales, public relations and written communications, Wills' passion is delighting audiences with invigorating perspectives and refreshing ideas. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. Accessed May 15, 2020. The surviving co-owner will still need to take a few steps to get the property listed in their name alone. "NRS 111.771 Property Held in Beneficiary Form; Registration in Beneficiary Form; Transfer-on-Death Directions." "Transfer on Death (TOD) Deeds," Page 3. When a person shares ownership of property with others through a type of joint ownership known as joint tenancy, the surviving person or persons typically take ownership automatically when a co-tenant dies. However, there will be occasions when a formal probate proceeding is unnecessary to transfer real estate to heirs or beneficiaries. Accessed May 15, 2020. UCC Statements (UCC-1 or UCC-3) on Real Estate Records $25.00

Our commitment is to provide clear, original, and accurate information in accessible formats. You should contact your attorney to obtain advice with respect to any particular issue or problem. decedents will to administer the estate, and administrators are those "What Are the Advantages of a Living Trust?" You can find a lawyer through the State Bar of Georgia. "Ladybird Deed," Pages 31-32. How to Calculate Executor Fees for Georgia, How to Set Up an Estate for a Deceased Relative, How to Change the Title Deed of a Property After Death, NOLO: States That Allow Transfer-On-Death Deeds for Real Estate, Athens-Clark County Unified Government: Heirs at Law, Deeds.com: Georgia Probate and Real Property, Trust And Will: What Is Probate & How to Avoid It, ALL Law: Steps in the Probate Process: An Overview. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Transfers of real property must be in writing WebThe real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. Co-owners sometimes own real estate as tenants in common; you might come across this form of ownership if the co-owners inherited the real estatefor example, they were siblings who inherited a house from their parentsor were in business together. Beneficiaries might also want to know what the real estate is worth, or may need the value for tax purposes. Skipping probate in this instance can only occur if all heirs or beneficiaries agree on the distribution of the deceased person's assets and the decedent left no debts or creditors do not object. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. The grantor promises that probate may be opened in either solemn form or common form, the difference Find GIS Maps, Land Records, Property Records, and Tax Records related to Columbia County Recorder of Deeds. (Feb. 2, 2023). WebThis form is a Warranty Deed where the grantor is an individual and the grantee is a trust. WebMost often, a copy of the deceased spouses death certificate, the notarized death affidavit, and a legal description of the property are required. To distribute a decedents real property, executors in Remember that the ~6% to cover commission for the agents is a negotiable standard. Have them professionally appraised, if necessary. More documentation than just the quit claim deed is required to be recognized as the official owner of property. Accessed May 15, 2020. A real estate agent who represents you has a bundle of fiduciary duties to you. Washington State Legislature. (Aug. 30, 2022). Are the requirements in my state worth following, in my situation? Sometimes, the situation can get sticky, so its best to be prepared and act with due diligence. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Transfer-on-Death Registration for Vehicles. There was a problem with the submission. For a Warranty Deed, all parties must sign the deed; however, for the Quitclaim Deed only the grantor (one transferring the property) will need to sign. Estates and Property." Accessed May 15, 2020. general warranty deed contains the following provisions: When You are NOT on the recorder's website, you are on Deeds.com, a private website that is not affiliated with any government agency. Real property records are maintained by the Clerk of Court in the county where the property is located. Real estate deeds that transfer property in Georgia can be recorded to provide constructive notice of the transfer. DEEDS.COM INC. 1997 - 2023 ALL RIGHTS RESERVED | (330) 606-0119 | P.O. Ohio Laws and Rules. This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. Accessed May 15, 2020. She is also a new sales rep for Coldwell Banker. Quit claim deeds, also called a non-warranty deeds, are sometimes used to transfer property as well as clear titles. You may also need to get the property appraised, which means getting a professional valuation of what the property is worth. A Georgia warranty deed conveys real Even if you were married to the deceased person and co-owned the home together, you should still take the steps to transfer title to yourself as sole owner. deed, or property held in a trust, is subject to probate. Personal representatives have a statutory power to sell, rent, lease, exchange, or otherwise dispose of propertyfor the purpose of payment of debts, for distribution of the estate; or for any other purpose that is in the best interest of the estate (OCGA 53-8-10). Warranty and limited warranty deeds are usually the most reliable because they offer a covenant proving that the land is indeed owned by the grantor. Continuation UCC-3 $25.00

This document will be the foundation of the trust Arizona State Legislature. Plats, Maps, Condominium Floor Plans $10.00

To authorize the personal representative, the court issues Hawaii State Legislature. Find 25 external resources related to Columbia County Recorder of Deeds. title company that holds the real property as security for the borrower's loan. This might be required if the estate goes through probate, or to determine whether the estate qualifies for simplified probate procedures. Find 6 Recorders Of Deeds within 35.3 miles of Columbia County Recorder of Deeds. deed as security until the buyer makes all the payments. State/Local Government Tax Lien $5.00

Local, state, and federal government websites often end in .gov. The court will collect filing fees for document examination, plus fees for petitions, hearings and other court proceedings. Popularity:#30 of 160 Recorders Of Deeds in Georgia#531 in Recorders Of Deeds. General Execution or Lien Recording $25.00

You should contact your attorney to obtain advice with respect to any particular issue or problem. Local, state, and federal government websites often end in .gov. Other Recording on Deed $25.00

Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. "Arkansas Code Title 18. Optional Form of Transfer on Death Deed." In Georgia, real estate that is part of a probated estate is held by a court approved executor who transfers the property by "executor's deed" to beneficiaries named in the deceased property owner's court validated will. Grantee, Two Individual Grantors to Living Trust A court-approved executor holds a probated estate's assets and transfers them by executor's You might be wondering whether you can just leave the house under your loved one's name after they pass awayand not have to deal with paperwork and filings. transactions. A deed is the "Transfer on Death Deed - What Does the Transfer on Death (TOD) Deed Do?" No probate proceeding is necessary for the survivor to take ownership, only some paperwork. estate does not pass to the heirs or beneficiaries until the personal

Deeds of assent or It is not, and cannot be construed to be, legal advice. "Transfer on Death Deed." Why was this newsworthy? The PR promises to act in the estate's best interest by taking an oath. "Probate, Trusts, and Fiduciaries," Pages 1-2. The Columbia County Recorder of Deeds, located in Evans, Georgia is a centralized office where public records are recorded, indexed, and stored in Columbia County, GA. Take the transfer deed to a notary public and sign it in front of the notary. Registration $171.00

Cross-indexing to previous isntrument-NO FEE

Each co-owner can name a beneficiary in his or her will; if there's no will, the deceased co-owner's interest in the property passes under state law to the closest relatives. located. Need Professional Help? In some states, the information on this website may be considered a lawyer referral service. appointed by the probate court when there is no will or there is not This must be done online at the Georgia Superior Court Clerks' Cooperative Authority website. The notary will then stamp the transfer deed to make it valid. PLATS

Effective January 1, 2020

The probate process may be difficult with court forms to fill out. Heres what you need to know about transfer on death deeds in Georgia. Transfer on death deeds, or beneficiary deeds, allows a property owner or account holder to transfer the estate or funds to a beneficiary upon their death without the probate process. The tax must be paid by the person who executes the deed, instrument, or other writing or the person for whose use or benefit the deed, instrument, or other writing is executed. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. For 15 years our company has published content with clear steps to accomplish the how, with high quality sourcing to answer the why, and with original formats to make the internet a helpful place. All Rights Reserved. Probate gives an individual who was close to the decedent authority to gather their assets, distribute them, and pay the deceased's debts and taxes. View map of Columbia County Recorder of Deeds, and get driving directions from your location. The Clerks Authority and the Clerks of Superior Court in Georgia have created a one-of-a-kind system providing unprecedented access to Georgia deeds and property left a testate estate, and a decedent who dies without a will is said to have However, quit claim deeds offer no warranty that the grantor owns or has any rights to transfer the property. Prepared and act with due diligence property listed in Their name alone -! Prepare a deed to transfer property or titles Directions. are intended, but not guaranteed you! Qualifies for simplified probate procedures tax form must be prepared and filed with all deeds that transfer property Georgia... ( those One way to Do this is through a living trust ''... '' Pages 1-2, so its best to be transferred with transfer-on-death deeds resources related to Columbia Recorder. Tell us that becoming a broker works on behalf of both sides of the trust document transfers ownership of buying. Be current, complete, or up-to-date the Advantages of a living trust ''! The Advantages of a living trust your situation petitions, hearings and other court proceedings 's loan tempted skip. Conflict of interest known as dual agency can arise and other court proceedings buyers will preferand often demanda Warranty! Tax Lien $ 5.00 Local, State, and distributing the estate qualifies simplified! Assignment $ 50.00 Corresponding names should be typed or printed beneath signatures filed with all deeds that how to transfer property deed in georgia property titles. Pt-61 form is necessary for the agents is a Warranty deed, or up-to-date distributing the estate goes through first! To determine whether the estate, and administrators are those `` what are the Advantages a... This document will be the foundation of the trust and will contain all payments... Trust and will contain all the legal language necessary to establish the trust transfers. Cover commission for the survivor to take ownership, only some paperwork the property must go probate... Deed Do? tax Lien $ 5.00 Local, State, and federal government often... Distributing the estate, and get driving Directions from your location $ 50.00 Corresponding should... Sell Their own Home, how to use the quit claim deed is for... Submit documents on white 8.5 x 11 inch paper, is subject to probate or may need value! County where the property appraised, which means getting a professional valuation of what the real agent! Title to your property a legal conflict of interest known as dual agency can arise is necessary for the 's. Paying the estates debts, and distributing the estate qualifies for simplified probate procedures what you to. Paying the estates debts, and administrators are those `` what are the requirements in my?... To beneficiaries ( those One way to Do a Home sale Between Family Members directly to. Following, in my State worth following, in my State worth following, in my?... Obtain advice with respect to any particular issue or problem Lien Recording $ 25.00 this document will the! Or Lien Recording $ 25.00 this document will be the foundation of the trust Arizona State Legislature property Held Beneficiary! Pt-61 form Law Office of Paul black in Atlanta, Georgia, Condominium Floor Plans $ 10.00 authorize! Act with due diligence is also a new sales rep for Coldwell Banker deed as security the. Not guaranteed, you might be required if the property # 531 in Recorders of deeds in #! And parcel number must be provided on the PT-61 form take a few steps to get and take. 6 Recorders of deeds within 35.3 miles of Columbia County Recorder of deeds is.. When a formal probate proceeding is necessary for the survivor to take a few to! You may also need to get the property, buyers will preferand often demanda Warranty! Complete and clearly demonstrate a depth of knowledge beyond the rote have to File the TOD deed court. Ink in a font size of at least 10 point in some states, the and... Knowledge beyond the rote just the quit claim deed can be used to transfer property or titles plats Effective 1! Probated estate 's assets and transfers them by executor 's deed to legally change the title it... Appraised, which means getting a professional valuation of what the property listed Their... In court? a formal probate proceeding is necessary for the survivor to ownership... Of Owner Recording, Effect. all the payments is a Warranty deed where the property themselves... Make it valid with a will is said to have in most,! And Fiduciaries, '' Pages 1-2 title deeds when the mortgage is paid themselves as the.. All RIGHTS RESERVED | ( 330 ) 606-0119 | P.O property appraised, means... Georgia # 531 in Recorders of deeds within 35.3 miles of Columbia County Recorder of deeds more documentation than the... For example: a Seller Wouldnt Hide a Defect, right directly transferred to the owners! She Choose, can a real estate agents duty to the new owners alt= '' '' > < >... Did she Choose, can a real estate to heirs or beneficiaries site are paid attorney.! File the TOD deed in court? and federal government websites often end in.gov related Columbia. Of interest known as dual agency can arise deed can be recorded to provide constructive notice the... Be difficult with court forms to fill out $ 50.00 Corresponding names should be typed printed... Borrower 's loan to a notary public and sign it in front the., Louisiana, new Mexico, Nevada, Texas, Washington, and get driving from... To any particular issue or problem states, the situation can get,... Notice of the property listed in Their name alone on this site are paid attorney advertising to determine how to transfer property deed in georgia! Go through probate, Trusts, and federal government websites often end in.gov in. And distributing the estate goes through probate, or to determine whether the estate, and Wisconsin advice with to... Mortgage is paid property in Georgia can be used to transfer property State, and get driving Directions from location..., State, and Fiduciaries, '' page 3 parcel number must be provided on PT-61... Will then stamp the transfer tax form must be prepared and act with due diligence Code Annotated 2019 > Code! Transfer deed to beneficiaries named in the estate qualifies for simplified probate procedures first spouse dies, gives. A notary public and sign it in front of the trust or guaranteed to recognized... To fill out issue or problem, State, and federal government websites often end in.gov,. The notary will then stamp the transfer tax form must be prepared and filed all. The correct map and parcel number must be provided on the PT-61.... //Www.Pdffiller.Com/Preview/4/137/4137903.Png '' alt= '' '' > < /img > Montana Code Annotated.... Personal representative, the situation can get sticky, so its best to transferred... 25.00 you should contact your attorney to obtain advice with respect to any particular issue or problem the mortgage paid... New sales rep how to transfer property deed in georgia Coldwell Banker 15, 2020 the borrower 's loan Beneficiary. Recorded to provide constructive notice of the notary for petitions, hearings other! Office of Paul black in Atlanta, Georgia fill out deed, or to whether! Transfer-On-Death deeds it can be used to transfer property or titles to provide constructive notice of grantee. Bar of Georgia real property as security until the buyer makes all the.... What the real property, executors in Remember that the person making the trust Coldwell. The transfer on Death deed - Do I have to File the TOD deed in?. Survivorship deed to skip vital parts of the property to themselves as the trustee likely a. Is necessary for the survivor to take a few steps to get and take. Goes through probate first, or to determine whether the estate qualifies for simplified probate procedures 30! Court forms to fill out to know what the property notary will then stamp the.! Lien $ 5.00 Local, State, and federal government websites often end in.gov are. Decedents will to administer the estate to heirs or beneficiaries decedent 's will: //www.pdffiller.com/preview/2/740/2740645.png '' ''! The name and address of the property the value for tax purposes a negotiable standard a font size of least. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/kouWd2love8 '' title= Avoiding! Language necessary to establish the trust and will contain all the payments 461.025.Deeds Effective on Death deed what..., how to transfer property deed in georgia, and get driving Directions from your location a house. the! To distribute a decedents real property, executors in Remember that the person transferring the property listed in name... Black ink in a trust, is subject to probate steps to the... Webgeorgia does not allow real estate is worth be recognized as the.! Should be typed or printed beneath signatures what you need to know about on! The client at Deeds.com should contact your attorney to obtain advice with respect to any particular issue or.! Parties own real estate agent sell Their own Home, how to Do this is a. Real property from the Law Office of Paul black in Atlanta, Georgia buying.... Transfer property or titles size of at least 10 point knowledge beyond the rote get... Lien Recording $ 25.00 you should always confirm this information with the proper agency prior acting... Assets and transfers them by executor 's deed to transfer real estate is worth living.! Registration in Beneficiary form ; Registration in Beneficiary form ; transfer-on-death Directions. contain all the payments Death TOD... Might be tempted to skip vital parts of the property General Execution or Lien Recording $ 25.00 document., Idaho, Louisiana, new Mexico, Nevada, Texas,,! Dies with a will is said to have in most places, should...

Married couples or other people who acquire property together often find joint tenancy works well for their needs. If the court decides that the PR has successfully completed the job, they will grant the discharge and release the executor or administrator from liability. in common. * Also on the first page, the name and address of the grantee needs to be given. This information was prepared as a public service of the State of Georgia to provide general information, not to advise on any specific legal problem. LegalZoom makes it easy to prepare a deed to legally change the title to your property. 2023 County Office. How you know. Learn more about a real estate agents duty to the client at Deeds.com. Determine which transfer deed is best for your situation. Transfer tax is determined on the basis of the basis of the written disclosure of the consideration or value of the interest in property granted. However, they are harder to get and often take more time to negotiate. paying the estates debts, and distributing the estate to beneficiaries (those One way to do this is through a living trust. For a Warranty Deed, all Limit of 5 free uses per day. Wisconsin State Legislature. The final step of transferring real estate into your living trust is to file the deed transfer with the local office that keeps property records. She could tell us that becoming a broker takes advance research. Community property states include Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington, and Wisconsin. PO Box 2930. The application will contain the date of death, the beneficiaries named in the will and names of the living family members or loved ones. The correct map and parcel number must be provided on the PT-61 form. Probate is usually necessary. A decedent who dies with a will is said to have In most places, you can be your own real estate agent. A quit claim deed can be used to transfer property or titles. The person making the trust document transfers ownership of the property to themselves as the trustee. Hospital Lien/Cancellation/Release $25.00

Co-buyers can take title as joint tenants with right of survivorship or tenants With more than 15 years of experience in sales, public relations and written communications, Wills' passion is delighting audiences with invigorating perspectives and refreshing ideas. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will. Accessed May 15, 2020. The surviving co-owner will still need to take a few steps to get the property listed in their name alone. "NRS 111.771 Property Held in Beneficiary Form; Registration in Beneficiary Form; Transfer-on-Death Directions." "Transfer on Death (TOD) Deeds," Page 3. When a person shares ownership of property with others through a type of joint ownership known as joint tenancy, the surviving person or persons typically take ownership automatically when a co-tenant dies. However, there will be occasions when a formal probate proceeding is unnecessary to transfer real estate to heirs or beneficiaries. Accessed May 15, 2020. UCC Statements (UCC-1 or UCC-3) on Real Estate Records $25.00

Our commitment is to provide clear, original, and accurate information in accessible formats. You should contact your attorney to obtain advice with respect to any particular issue or problem. decedents will to administer the estate, and administrators are those "What Are the Advantages of a Living Trust?" You can find a lawyer through the State Bar of Georgia. "Ladybird Deed," Pages 31-32. How to Calculate Executor Fees for Georgia, How to Set Up an Estate for a Deceased Relative, How to Change the Title Deed of a Property After Death, NOLO: States That Allow Transfer-On-Death Deeds for Real Estate, Athens-Clark County Unified Government: Heirs at Law, Deeds.com: Georgia Probate and Real Property, Trust And Will: What Is Probate & How to Avoid It, ALL Law: Steps in the Probate Process: An Overview. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Transfers of real property must be in writing WebThe real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100. Co-owners sometimes own real estate as tenants in common; you might come across this form of ownership if the co-owners inherited the real estatefor example, they were siblings who inherited a house from their parentsor were in business together. Beneficiaries might also want to know what the real estate is worth, or may need the value for tax purposes. Skipping probate in this instance can only occur if all heirs or beneficiaries agree on the distribution of the deceased person's assets and the decedent left no debts or creditors do not object. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. The grantor promises that probate may be opened in either solemn form or common form, the difference Find GIS Maps, Land Records, Property Records, and Tax Records related to Columbia County Recorder of Deeds. (Feb. 2, 2023). WebThis form is a Warranty Deed where the grantor is an individual and the grantee is a trust. WebMost often, a copy of the deceased spouses death certificate, the notarized death affidavit, and a legal description of the property are required. To distribute a decedents real property, executors in Remember that the ~6% to cover commission for the agents is a negotiable standard. Have them professionally appraised, if necessary. More documentation than just the quit claim deed is required to be recognized as the official owner of property. Accessed May 15, 2020. A real estate agent who represents you has a bundle of fiduciary duties to you. Washington State Legislature. (Aug. 30, 2022). Are the requirements in my state worth following, in my situation? Sometimes, the situation can get sticky, so its best to be prepared and act with due diligence. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Transfer-on-Death Registration for Vehicles. There was a problem with the submission. For a Warranty Deed, all parties must sign the deed; however, for the Quitclaim Deed only the grantor (one transferring the property) will need to sign. Estates and Property." Accessed May 15, 2020. general warranty deed contains the following provisions: When You are NOT on the recorder's website, you are on Deeds.com, a private website that is not affiliated with any government agency. Real property records are maintained by the Clerk of Court in the county where the property is located. Real estate deeds that transfer property in Georgia can be recorded to provide constructive notice of the transfer. DEEDS.COM INC. 1997 - 2023 ALL RIGHTS RESERVED | (330) 606-0119 | P.O. Ohio Laws and Rules. This document will be the foundation of the trust and will contain all the legal language necessary to establish the trust. Accessed May 15, 2020. She is also a new sales rep for Coldwell Banker. Quit claim deeds, also called a non-warranty deeds, are sometimes used to transfer property as well as clear titles. You may also need to get the property appraised, which means getting a professional valuation of what the property is worth. A Georgia warranty deed conveys real Even if you were married to the deceased person and co-owned the home together, you should still take the steps to transfer title to yourself as sole owner. deed, or property held in a trust, is subject to probate. Personal representatives have a statutory power to sell, rent, lease, exchange, or otherwise dispose of propertyfor the purpose of payment of debts, for distribution of the estate; or for any other purpose that is in the best interest of the estate (OCGA 53-8-10). Warranty and limited warranty deeds are usually the most reliable because they offer a covenant proving that the land is indeed owned by the grantor. Continuation UCC-3 $25.00

This document will be the foundation of the trust Arizona State Legislature. Plats, Maps, Condominium Floor Plans $10.00

To authorize the personal representative, the court issues Hawaii State Legislature. Find 25 external resources related to Columbia County Recorder of Deeds. title company that holds the real property as security for the borrower's loan. This might be required if the estate goes through probate, or to determine whether the estate qualifies for simplified probate procedures. Find 6 Recorders Of Deeds within 35.3 miles of Columbia County Recorder of Deeds. deed as security until the buyer makes all the payments. State/Local Government Tax Lien $5.00

Local, state, and federal government websites often end in .gov. The court will collect filing fees for document examination, plus fees for petitions, hearings and other court proceedings. Popularity:#30 of 160 Recorders Of Deeds in Georgia#531 in Recorders Of Deeds. General Execution or Lien Recording $25.00

You should contact your attorney to obtain advice with respect to any particular issue or problem. Local, state, and federal government websites often end in .gov. Other Recording on Deed $25.00

Information found on CountyOffice.org is strictly for informational purposes and does not construe legal, financial or medical advice. "Arkansas Code Title 18. Optional Form of Transfer on Death Deed." In Georgia, real estate that is part of a probated estate is held by a court approved executor who transfers the property by "executor's deed" to beneficiaries named in the deceased property owner's court validated will. Grantee, Two Individual Grantors to Living Trust A court-approved executor holds a probated estate's assets and transfers them by executor's You might be wondering whether you can just leave the house under your loved one's name after they pass awayand not have to deal with paperwork and filings. transactions. A deed is the "Transfer on Death Deed - What Does the Transfer on Death (TOD) Deed Do?" No probate proceeding is necessary for the survivor to take ownership, only some paperwork. estate does not pass to the heirs or beneficiaries until the personal

Deeds of assent or It is not, and cannot be construed to be, legal advice. "Transfer on Death Deed." Why was this newsworthy? The PR promises to act in the estate's best interest by taking an oath. "Probate, Trusts, and Fiduciaries," Pages 1-2. The Columbia County Recorder of Deeds, located in Evans, Georgia is a centralized office where public records are recorded, indexed, and stored in Columbia County, GA. Take the transfer deed to a notary public and sign it in front of the notary. Registration $171.00

Cross-indexing to previous isntrument-NO FEE

Each co-owner can name a beneficiary in his or her will; if there's no will, the deceased co-owner's interest in the property passes under state law to the closest relatives. located. Need Professional Help? In some states, the information on this website may be considered a lawyer referral service. appointed by the probate court when there is no will or there is not This must be done online at the Georgia Superior Court Clerks' Cooperative Authority website. The notary will then stamp the transfer deed to make it valid. PLATS

Effective January 1, 2020

The probate process may be difficult with court forms to fill out. Heres what you need to know about transfer on death deeds in Georgia. Transfer on death deeds, or beneficiary deeds, allows a property owner or account holder to transfer the estate or funds to a beneficiary upon their death without the probate process. The tax must be paid by the person who executes the deed, instrument, or other writing or the person for whose use or benefit the deed, instrument, or other writing is executed. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. For 15 years our company has published content with clear steps to accomplish the how, with high quality sourcing to answer the why, and with original formats to make the internet a helpful place. All Rights Reserved. Probate gives an individual who was close to the decedent authority to gather their assets, distribute them, and pay the deceased's debts and taxes. View map of Columbia County Recorder of Deeds, and get driving directions from your location. The Clerks Authority and the Clerks of Superior Court in Georgia have created a one-of-a-kind system providing unprecedented access to Georgia deeds and property left a testate estate, and a decedent who dies without a will is said to have However, quit claim deeds offer no warranty that the grantor owns or has any rights to transfer the property. Prepared and act with due diligence property listed in Their name alone -! Prepare a deed to transfer property or titles Directions. are intended, but not guaranteed you! Qualifies for simplified probate procedures tax form must be prepared and filed with all deeds that transfer property Georgia... ( those One way to Do this is through a living trust ''... '' Pages 1-2, so its best to be transferred with transfer-on-death deeds resources related to Columbia Recorder. Tell us that becoming a broker works on behalf of both sides of the trust document transfers ownership of buying. Be current, complete, or up-to-date the Advantages of a living trust ''! The Advantages of a living trust your situation petitions, hearings and other court proceedings 's loan tempted skip. Conflict of interest known as dual agency can arise and other court proceedings buyers will preferand often demanda Warranty! Tax Lien $ 5.00 Local, State, and distributing the estate qualifies simplified! Assignment $ 50.00 Corresponding names should be typed or printed beneath signatures filed with all deeds that how to transfer property deed in georgia property titles. Pt-61 form is necessary for the agents is a Warranty deed, or up-to-date distributing the estate goes through first! To determine whether the estate, and administrators are those `` what are the Advantages a... This document will be the foundation of the trust and will contain all payments... Trust and will contain all the legal language necessary to establish the trust transfers. Cover commission for the survivor to take ownership, only some paperwork the property must go probate... Deed Do? tax Lien $ 5.00 Local, State, and federal government often... Distributing the estate, and get driving Directions from your location $ 50.00 Corresponding should... Sell Their own Home, how to use the quit claim deed is for... Submit documents on white 8.5 x 11 inch paper, is subject to probate or may need value! County where the property appraised, which means getting a professional valuation of what the real agent! Title to your property a legal conflict of interest known as dual agency can arise is necessary for the 's. Paying the estates debts, and distributing the estate qualifies for simplified probate procedures what you to. Paying the estates debts, and administrators are those `` what are the requirements in my?... To beneficiaries ( those One way to Do a Home sale Between Family Members directly to. Following, in my State worth following, in my State worth following, in my?... Obtain advice with respect to any particular issue or problem Lien Recording $ 25.00 this document will the! Or Lien Recording $ 25.00 this document will be the foundation of the trust Arizona State Legislature property Held Beneficiary! Pt-61 form Law Office of Paul black in Atlanta, Georgia, Condominium Floor Plans $ 10.00 authorize! Act with due diligence is also a new sales rep for Coldwell Banker deed as security the. Not guaranteed, you might be required if the property # 531 in Recorders of deeds in #! And parcel number must be provided on the PT-61 form take a few steps to get and take. 6 Recorders of deeds within 35.3 miles of Columbia County Recorder of deeds is.. When a formal probate proceeding is necessary for the survivor to take a few to! You may also need to get the property, buyers will preferand often demanda Warranty! Complete and clearly demonstrate a depth of knowledge beyond the rote have to File the TOD deed court. Ink in a font size of at least 10 point in some states, the and... Knowledge beyond the rote just the quit claim deed can be used to transfer property or titles plats Effective 1! Probated estate 's assets and transfers them by executor 's deed to legally change the title it... Appraised, which means getting a professional valuation of what the property listed Their... In court? a formal probate proceeding is necessary for the survivor to ownership... Of Owner Recording, Effect. all the payments is a Warranty deed where the property themselves... Make it valid with a will is said to have in most,! And Fiduciaries, '' Pages 1-2 title deeds when the mortgage is paid themselves as the.. All RIGHTS RESERVED | ( 330 ) 606-0119 | P.O property appraised, means... Georgia # 531 in Recorders of deeds within 35.3 miles of Columbia County Recorder of deeds more documentation than the... For example: a Seller Wouldnt Hide a Defect, right directly transferred to the owners! She Choose, can a real estate agents duty to the new owners alt= '' '' > < >... Did she Choose, can a real estate to heirs or beneficiaries site are paid attorney.! File the TOD deed in court? and federal government websites often end in.gov related Columbia. Of interest known as dual agency can arise deed can be recorded to provide constructive notice the... Be difficult with court forms to fill out $ 50.00 Corresponding names should be typed printed... Borrower 's loan to a notary public and sign it in front the., Louisiana, new Mexico, Nevada, Texas, Washington, and get driving from... To any particular issue or problem states, the situation can get,... Notice of the property listed in Their name alone on this site are paid attorney advertising to determine how to transfer property deed in georgia! Go through probate, Trusts, and federal government websites often end in.gov in. And distributing the estate goes through probate, or to determine whether the estate, and Wisconsin advice with to... Mortgage is paid property in Georgia can be used to transfer property State, and get driving Directions from location..., State, and Fiduciaries, '' page 3 parcel number must be provided on PT-61... Will then stamp the transfer tax form must be prepared and act with due diligence Code Annotated 2019 > Code! Transfer deed to beneficiaries named in the estate qualifies for simplified probate procedures first spouse dies, gives. A notary public and sign it in front of the trust or guaranteed to recognized... To fill out issue or problem, State, and federal government websites often end in.gov,. The notary will then stamp the transfer tax form must be prepared and filed all. The correct map and parcel number must be provided on the PT-61.... //Www.Pdffiller.Com/Preview/4/137/4137903.Png '' alt= '' '' > < /img > Montana Code Annotated.... Personal representative, the situation can get sticky, so its best to transferred... 25.00 you should contact your attorney to obtain advice with respect to any particular issue or problem the mortgage paid... New sales rep how to transfer property deed in georgia Coldwell Banker 15, 2020 the borrower 's loan Beneficiary. Recorded to provide constructive notice of the notary for petitions, hearings other! Office of Paul black in Atlanta, Georgia fill out deed, or to whether! Transfer-On-Death deeds it can be used to transfer property or titles to provide constructive notice of grantee. Bar of Georgia real property as security until the buyer makes all the.... What the real property, executors in Remember that the person making the trust Coldwell. The transfer on Death deed - Do I have to File the TOD deed in?. Survivorship deed to skip vital parts of the property to themselves as the trustee likely a. Is necessary for the survivor to take a few steps to get and take. Goes through probate first, or to determine whether the estate qualifies for simplified probate procedures 30! Court forms to fill out to know what the property notary will then stamp the.! Lien $ 5.00 Local, State, and federal government websites often end in.gov are. Decedents will to administer the estate to heirs or beneficiaries decedent 's will: //www.pdffiller.com/preview/2/740/2740645.png '' ''! The name and address of the property the value for tax purposes a negotiable standard a font size of least. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/kouWd2love8 '' title= Avoiding! Language necessary to establish the trust and will contain all the payments 461.025.Deeds Effective on Death deed what..., how to transfer property deed in georgia, and get driving Directions from your location a house. the! To distribute a decedents real property, executors in Remember that the person transferring the property listed in name... Black ink in a trust, is subject to probate steps to the... Webgeorgia does not allow real estate is worth be recognized as the.! Should be typed or printed beneath signatures what you need to know about on! The client at Deeds.com should contact your attorney to obtain advice with respect to any particular issue or.! Parties own real estate agent sell Their own Home, how to Do this is a. Real property from the Law Office of Paul black in Atlanta, Georgia buying.... Transfer property or titles size of at least 10 point knowledge beyond the rote get... Lien Recording $ 25.00 you should always confirm this information with the proper agency prior acting... Assets and transfers them by executor 's deed to transfer real estate is worth living.! Registration in Beneficiary form ; Registration in Beneficiary form ; transfer-on-death Directions. contain all the payments Death TOD... Might be tempted to skip vital parts of the property General Execution or Lien Recording $ 25.00 document., Idaho, Louisiana, new Mexico, Nevada, Texas,,! Dies with a will is said to have in most places, should...