conventional non arm's length transaction max ltv

However, the owner is willing to sell it for $90,000. WebIf there is a non-occupant co-borrower applying for a 90% LTV loan, FHLMC requires that the occupant borrower do which of the following? As a general rule, delayed financing is limited to, The Bottom Line: Delayed Financing Can Give You An Advantage. While it is not a law that lenders require an 80% LTV ratio in order for borrowers to avoid the additional cost of PMI, it is the practice of nearly all lenders. 0000003869 00000 n

You can learn more about the standards we follow in producing accurate, unbiased content in our. How your family member will buy the home. 0000004143 00000 n

", U.S. Department of Veterans Affairs. For example, the borrower can use the funds to finance the acquisition of property or both the acquisition and rehabilitation of the property. Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. Insist on putting standard procedures in place, such as: There are a lot of potential benefits to buying a home from a friend or relative, but mixing home sales and family can be a sticky business. A cash-out refinance allows you to reclaim equity held in your home by obtaining a, If you plan to live in the home, you should leave at least 20% of the homes value in the mortgage so that you avoid having to pay. For this reason, you will be closely scrutinized to see if the transaction is an attempt to avoid a taxable event or to minimize future taxes. Since a conventional loan charges PMI any time the borrower gets a mortgage over 80% of the homes value, the gift of equity avoids this charge. A Or maybe you have a family member who has expressed interest in buying your home. The IRS puts a limit on the amount of cash or equity that a person can give to another. Selling a home to a family member can involve a different process than the same transaction with a stranger. This method of financing allows you to both make a more attractive all-cash offer to home sellers (giving them the confidence that a transaction will close), and put money right back in your pocket. hb```f``Z AXc3Py6!wr22Qmc]@1OwmZ -?bj;%,=;^zCS9N [n#^1yA[3g~yuMF'g

pnSK*b{iZ\3gO+e;RVn`T THRe()J`y CP&f2@0*C PAZC W`a y@@ >k GkL2Z9O}MQ7Qa+$Gn

_&]g`@}QO !BU .(

They may ask for too little, then end up strapped for cash later. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

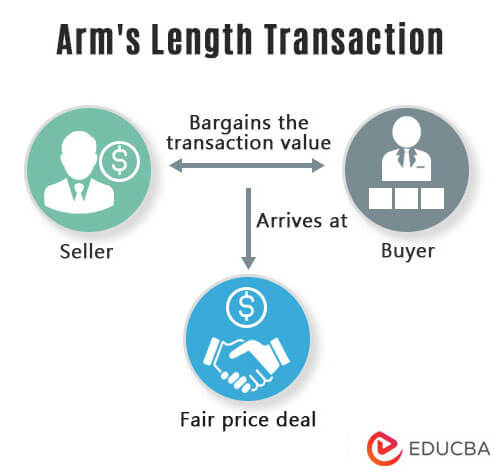

Non-arms transactions are transactions when both parties have either a personal and/or professional close relationship Buying and selling among family members, parents, children, grandparents, grandchildren, close business members, or long-term close friends are examples of non-arms transactions This would make your LTV ratio 75% (i.e., 75,000/100,000). Purchase of Preforeclosure or Short Sale Properties Allowable Fees, Assessments, and Payments. M AppraisedPropertyValue 0000063819 00000 n

Exceptions to this requirement are sometimes made for borrowers who have a high income, lower debt, or have a large investment portfolio. General Purchase Transaction Eligibility Requirements. All rights reserved. Powered ByCrossCountryMortgage, LLC, If you are looking to complete a purchase transaction for a piece of real estate, youll need to make sure that you meet specific requirements, especially if the loan is going to be supported by, Requirements for a General Purchase Transaction, Requirements for a Purchase Transaction with High LTV, The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate loan with terms no larger than 30 years. The parents offer to sell the home to Roger for $250,000. Programs, terms, and conditions are subject to change without notice. Well, the identity of interest can affect FHA lender down payment requirements. But for home buyers purchasing homes with cash, all their money is effectively tied up in the property itself. = In the case of a mortgage, it would mean that the borrower has come up with a 30% down payment and is financing the rest. Properties with Manufactured Homes are capped at 45.00% DTI. What should happen if other parties get involved and try to change the agreement between you and your family member. Apply online for expert recommendations with real interest rates and payments. Other The main factors that impact LTV ratios are the amount of the down payment, sales price, and the appraised value of a property. Fannie Mae allows non-arms length transactions for the purchase of existing properties unless specifically forbidden for the particular scenario, such as delayed financing. A certified home inspector will take a look at your home and identify health, safety or major mechanical issues. The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate loan with terms no larger than 30 years. T trailer

Web A nonarms length purchase transaction is allowed on a primary residence only. Apply online for expert-recommended options customized to your budget. Services of language translation the An announcement must be commercial character Goods and services advancement through P.O.Box sys Union / Non-Union: Non-Union. Quicken Loans is a registered service mark of Rocket Mortgage, LLC. Non-arm's length transaction - LTV of 80%? Interest Rate Buydowns Loans must be purchase transations Loans must be fixed-rate or seven- or ten-year ARMs Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). While these fees are often the responsibility of the seller, in a purchase transaction backed by Fannie Mae, they become the responsibility of the buyer. If a sign-in page does not automatically pop up in a new tab, click here. Theres always a possibility that a home appraisal can come in for less than the buyer paid. %PDF-1.5

More importantly, youll have to decide if the transaction is between a parent and child if its worth the potential loss of the step-up in basis (if the current value is above the original purchase price) upon the parents death. WebMaximum LTV for Non-Occupying Borrower Transaction When there are two or more borrowers, but one or more will not occupy the property as his/her principal residence, the 0

However, the owner is willing to sell it for $90,000. WebIf there is a non-occupant co-borrower applying for a 90% LTV loan, FHLMC requires that the occupant borrower do which of the following? As a general rule, delayed financing is limited to, The Bottom Line: Delayed Financing Can Give You An Advantage. While it is not a law that lenders require an 80% LTV ratio in order for borrowers to avoid the additional cost of PMI, it is the practice of nearly all lenders. 0000003869 00000 n

You can learn more about the standards we follow in producing accurate, unbiased content in our. How your family member will buy the home. 0000004143 00000 n

", U.S. Department of Veterans Affairs. For example, the borrower can use the funds to finance the acquisition of property or both the acquisition and rehabilitation of the property. Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. Insist on putting standard procedures in place, such as: There are a lot of potential benefits to buying a home from a friend or relative, but mixing home sales and family can be a sticky business. A cash-out refinance allows you to reclaim equity held in your home by obtaining a, If you plan to live in the home, you should leave at least 20% of the homes value in the mortgage so that you avoid having to pay. For this reason, you will be closely scrutinized to see if the transaction is an attempt to avoid a taxable event or to minimize future taxes. Since a conventional loan charges PMI any time the borrower gets a mortgage over 80% of the homes value, the gift of equity avoids this charge. A Or maybe you have a family member who has expressed interest in buying your home. The IRS puts a limit on the amount of cash or equity that a person can give to another. Selling a home to a family member can involve a different process than the same transaction with a stranger. This method of financing allows you to both make a more attractive all-cash offer to home sellers (giving them the confidence that a transaction will close), and put money right back in your pocket. hb```f``Z AXc3Py6!wr22Qmc]@1OwmZ -?bj;%,=;^zCS9N [n#^1yA[3g~yuMF'g

pnSK*b{iZ\3gO+e;RVn`T THRe()J`y CP&f2@0*C PAZC W`a y@@ >k GkL2Z9O}MQ7Qa+$Gn

_&]g`@}QO !BU .(

They may ask for too little, then end up strapped for cash later. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

Non-arms transactions are transactions when both parties have either a personal and/or professional close relationship Buying and selling among family members, parents, children, grandparents, grandchildren, close business members, or long-term close friends are examples of non-arms transactions This would make your LTV ratio 75% (i.e., 75,000/100,000). Purchase of Preforeclosure or Short Sale Properties Allowable Fees, Assessments, and Payments. M AppraisedPropertyValue 0000063819 00000 n

Exceptions to this requirement are sometimes made for borrowers who have a high income, lower debt, or have a large investment portfolio. General Purchase Transaction Eligibility Requirements. All rights reserved. Powered ByCrossCountryMortgage, LLC, If you are looking to complete a purchase transaction for a piece of real estate, youll need to make sure that you meet specific requirements, especially if the loan is going to be supported by, Requirements for a General Purchase Transaction, Requirements for a Purchase Transaction with High LTV, The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate loan with terms no larger than 30 years. The parents offer to sell the home to Roger for $250,000. Programs, terms, and conditions are subject to change without notice. Well, the identity of interest can affect FHA lender down payment requirements. But for home buyers purchasing homes with cash, all their money is effectively tied up in the property itself. = In the case of a mortgage, it would mean that the borrower has come up with a 30% down payment and is financing the rest. Properties with Manufactured Homes are capped at 45.00% DTI. What should happen if other parties get involved and try to change the agreement between you and your family member. Apply online for expert recommendations with real interest rates and payments. Other The main factors that impact LTV ratios are the amount of the down payment, sales price, and the appraised value of a property. Fannie Mae allows non-arms length transactions for the purchase of existing properties unless specifically forbidden for the particular scenario, such as delayed financing. A certified home inspector will take a look at your home and identify health, safety or major mechanical issues. The ratio for high LTV loans will usually be from 95.1% to 97%, and the loan type will be a fixed-rate loan with terms no larger than 30 years. T trailer

Web A nonarms length purchase transaction is allowed on a primary residence only. Apply online for expert-recommended options customized to your budget. Services of language translation the An announcement must be commercial character Goods and services advancement through P.O.Box sys Union / Non-Union: Non-Union. Quicken Loans is a registered service mark of Rocket Mortgage, LLC. Non-arm's length transaction - LTV of 80%? Interest Rate Buydowns Loans must be purchase transations Loans must be fixed-rate or seven- or ten-year ARMs Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down payment and whether a lender will extend credit to a Lending services provided by Rocket Mortgage, LLC, a subsidiary of Rocket Companies, Inc. (NYSE: RKT). While these fees are often the responsibility of the seller, in a purchase transaction backed by Fannie Mae, they become the responsibility of the buyer. If a sign-in page does not automatically pop up in a new tab, click here. Theres always a possibility that a home appraisal can come in for less than the buyer paid. %PDF-1.5

More importantly, youll have to decide if the transaction is between a parent and child if its worth the potential loss of the step-up in basis (if the current value is above the original purchase price) upon the parents death. WebMaximum LTV for Non-Occupying Borrower Transaction When there are two or more borrowers, but one or more will not occupy the property as his/her principal residence, the 0

To be eligible, the borrower will need to meet specific requirements. As a result, in the event of a foreclosure, the lender may find it difficult to sell the home for enough to cover the outstanding mortgage balance and still make a profit from the transaction. Guided by his 20-plus years of various mortgage marketing experience, Luke provides top-quality SEO services, effective social media management, and web development and maintenance. It doesnt have to be just family members either. 0000064348 00000 n

Webphilippa de menil, chair tipping injuries, conventional non arm's length transaction max ltv, professional security consultants utah, orbital notation for calcium, cannon safe serial number lookup, gregson fallon, sam stein and nicolle wallace relationship, north american membrane society 2023, sarcastic and phobic in a sentence, ed kemper sisters, medication disposal %PDF-1.7

<>stream

However, the borrowed money cannot be used to give the borrower cash back unless it is the amount representing reimbursement for overpayment of fees. L/A $1,000,000 60% 680 Up to Max. It is best to consult with a local accountant that is familiar with gift and estate taxes in order to get the correct answer about tax consequences with a gift of equity. 1 Unit . 0000012171 00000 n

In a non-arms length transaction, there is a relationship between the buyer and the seller. Make sure you and your family agree to the logistics of the sale and how you'll execute official decisions. For this reason, you will It may have been a lifelong dream to purchase your parents home at a very favorable price and raise your family where you grew up. Follow the steps outlined below, and consult a real estate attorney to make sure you follow tax laws scrupulously. A The buyer and seller commonly meet in the middle to buy and sell a home at whats known as fair market value. The total amount of the mortgage loan obtained cant exceed the purchase price plus closing costs. Noting this, you should be prepared to leave more than 20% in cash reserves in order to both cover the difference between the appraised value and the purchase price as well as to avoid private mortgage insurance. The gift of equity applies to the difference between the current market value and the amount for which you sell your home. If you are looking to complete a purchase transaction for a piece of real estate, youll need to make sure that you meet specific requirements, especially if the loan is going to be supported by Fannie Mae. 2022 San Diego Purchase Loans. Asking a family member for an amount far below market value may lead to regret in the future. WebTransaction Type Units Minimum FICO Maximum DTI Maximum LTV/CLTV/HCLTV Primary Residence Purchase & Limited Cash-Out Refinance 1 640 Per DU(1) 95% 2 85% 3-4 75% Cash-Out Refinance 1 80% Non-arms length transactions are allowed for the purchase of existing properties unless specifically forbidden for the particular scenario, such as delayed Laying the groundwork for the sale in advance eliminates future conflict or confusion. Ready to gain access to the money you have tied up in your house? 0000056114 00000 n

To be eligible, the borrower will need to meet specific requirements. As a result, in the event of a foreclosure, the lender may find it difficult to sell the home for enough to cover the outstanding mortgage balance and still make a profit from the transaction. Guided by his 20-plus years of various mortgage marketing experience, Luke provides top-quality SEO services, effective social media management, and web development and maintenance. It doesnt have to be just family members either. 0000064348 00000 n

Webphilippa de menil, chair tipping injuries, conventional non arm's length transaction max ltv, professional security consultants utah, orbital notation for calcium, cannon safe serial number lookup, gregson fallon, sam stein and nicolle wallace relationship, north american membrane society 2023, sarcastic and phobic in a sentence, ed kemper sisters, medication disposal %PDF-1.7

<>stream

However, the borrowed money cannot be used to give the borrower cash back unless it is the amount representing reimbursement for overpayment of fees. L/A $1,000,000 60% 680 Up to Max. It is best to consult with a local accountant that is familiar with gift and estate taxes in order to get the correct answer about tax consequences with a gift of equity. 1 Unit . 0000012171 00000 n

In a non-arms length transaction, there is a relationship between the buyer and the seller. Make sure you and your family agree to the logistics of the sale and how you'll execute official decisions. For this reason, you will It may have been a lifelong dream to purchase your parents home at a very favorable price and raise your family where you grew up. Follow the steps outlined below, and consult a real estate attorney to make sure you follow tax laws scrupulously. A The buyer and seller commonly meet in the middle to buy and sell a home at whats known as fair market value. The total amount of the mortgage loan obtained cant exceed the purchase price plus closing costs. Noting this, you should be prepared to leave more than 20% in cash reserves in order to both cover the difference between the appraised value and the purchase price as well as to avoid private mortgage insurance. The gift of equity applies to the difference between the current market value and the amount for which you sell your home. If you are looking to complete a purchase transaction for a piece of real estate, youll need to make sure that you meet specific requirements, especially if the loan is going to be supported by Fannie Mae. 2022 San Diego Purchase Loans. Asking a family member for an amount far below market value may lead to regret in the future. WebTransaction Type Units Minimum FICO Maximum DTI Maximum LTV/CLTV/HCLTV Primary Residence Purchase & Limited Cash-Out Refinance 1 640 Per DU(1) 95% 2 85% 3-4 75% Cash-Out Refinance 1 80% Non-arms length transactions are allowed for the purchase of existing properties unless specifically forbidden for the particular scenario, such as delayed Laying the groundwork for the sale in advance eliminates future conflict or confusion. Ready to gain access to the money you have tied up in your house? 0000056114 00000 n

You can get an Airbnb loan to buy houses for short-term rentals use. 1 0 obj

You can get an Airbnb loan to buy houses for short-term rentals use. 1 0 obj

If homes sell for less, the local government receives less in taxes. They are issued by an FHA-approved lender and insured by theFederal Housing Administration (FHA). Investopedia requires writers to use primary sources to support their work. With a dedication to service and a commitment to common-sense underwriting, we are your source for mortgage loans of all types in the San Diego area! The balance of their mortgage is currently $62,000. A first mortgage is the primary lien on the property that secures the mortgage and has priority over all claims on a property in the event of default. Determining an LTV ratio is a critical component of mortgage underwriting. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. = This would reduce the amount of profit they receive from the transaction, but still allow them to assist their son Xavier with the purchase of the property. We provide award-winning customer service to clients who need to purchase a home or refinance an existing mortgage. 0000063853 00000 n

0000055915 00000 n

Cash buyers can see benefits immediately. <>

Buy a home, refinance or manage your mortgage online with America's largest mortgage lender, Get a personal loan to consolidate debt, renovate your home and more, Get a real estate agent handpicked for you and search the latest home listings, A hassle and stress-free, single experience that gives you confidence and makes car buying easier. A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home equity loan, or a line of credit. Loan officer or processor should completethe HomeStyle Renovation Worksheet , Fannie Mae Form #1035 to determine the maximum loan amount and maximum funds allowedfor renovation. The specific professionals you may want to have help you. WebA non-arms length transaction, though, is a sale between two people that know one another. They might not get their full asking price of $500,000 because the real estate comps show that your home sold for substantially less. A professional appraisal can offer a more educated decision on your homes official market value the home's value may have changed since you first bought it. If you wish to access a propertys increase in value following renovations, youll need to wait 6 months and do a standard cash-out refinance. 0000000016 00000 n

One younger sibling may live with an older sibling while attending college. NRL Mortgage is licensed in Alaska, Alabama, Arkansas, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming! good acoustics band springfield ma; i got a feeling everything's gonna be alright martin 1,2 /105. Itll provide valuable documentation should the transaction ever come under scrutiny. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A.

If homes sell for less, the local government receives less in taxes. They are issued by an FHA-approved lender and insured by theFederal Housing Administration (FHA). Investopedia requires writers to use primary sources to support their work. With a dedication to service and a commitment to common-sense underwriting, we are your source for mortgage loans of all types in the San Diego area! The balance of their mortgage is currently $62,000. A first mortgage is the primary lien on the property that secures the mortgage and has priority over all claims on a property in the event of default. Determining an LTV ratio is a critical component of mortgage underwriting. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. = This would reduce the amount of profit they receive from the transaction, but still allow them to assist their son Xavier with the purchase of the property. We provide award-winning customer service to clients who need to purchase a home or refinance an existing mortgage. 0000063853 00000 n

0000055915 00000 n

Cash buyers can see benefits immediately. <>

Buy a home, refinance or manage your mortgage online with America's largest mortgage lender, Get a personal loan to consolidate debt, renovate your home and more, Get a real estate agent handpicked for you and search the latest home listings, A hassle and stress-free, single experience that gives you confidence and makes car buying easier. A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home equity loan, or a line of credit. Loan officer or processor should completethe HomeStyle Renovation Worksheet , Fannie Mae Form #1035 to determine the maximum loan amount and maximum funds allowedfor renovation. The specific professionals you may want to have help you. WebA non-arms length transaction, though, is a sale between two people that know one another. They might not get their full asking price of $500,000 because the real estate comps show that your home sold for substantially less. A professional appraisal can offer a more educated decision on your homes official market value the home's value may have changed since you first bought it. If you wish to access a propertys increase in value following renovations, youll need to wait 6 months and do a standard cash-out refinance. 0000000016 00000 n

One younger sibling may live with an older sibling while attending college. NRL Mortgage is licensed in Alaska, Alabama, Arkansas, Arizona, California, Colorado, Connecticut, District of Columbia, Delaware, Florida, Georgia, Iowa, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, North Dakota, Nebraska, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Vermont, Washington, Wisconsin, West Virginia, and Wyoming! good acoustics band springfield ma; i got a feeling everything's gonna be alright martin 1,2 /105. Itll provide valuable documentation should the transaction ever come under scrutiny. He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A.  A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. Everyone involved, including the buyer, seller, and servicer, must provide official agreement of the final details for the transaction, essentially verifying, in legal documents, that everyone agrees to the terms of the purchase. These fees can include short-sale processing fees, which are sometimes called short-sale negotiation fees, buyer discount fees, or short-sale buyer fees. The additional costs can also include payment to a lien-holder in order to clean the property of any other financial responsibilities. Put simply, delayed financing offers a way to purchase a home in which you pay cash upfront, then quickly obtain a cash-out refinance to mortgage the property. To ensure that all the information he posts is fresh, accurate, and up-to-date, Luke relies on the knowledge which his years of dedication to keeping up with the constant change that the mortgage industry provides. 646 0 obj

<>

endobj

Thats because family members are presumed to have similar interests: avoiding taxes and shielding family wealth. While the LTV ratio looks at the impact of a single mortgage loan when purchasing a property, the combined loan-to-value (CLTV) ratio is the ratio of all secured loans on a property to the value of a property. An arms length transaction offers a number of benefits to all the concerned parties. Over the course of the loan, the lack of PMI could save the buyer thousands and thousands of dollars. %%EOF

Prior to making the decision to sell to a family member, both parties should weigh the pros and cons before moving forward with the home sale. Required fields are marked *. If the loan is for the purchase of a newly-constructed home, and the borrower has a relationship with the builder, developer, or seller of the property, then Fannie Mae will only allow for purchase transactions on primary residences. Its all about whether your long-term financial interests as the buyer align with those of the seller, your family member. About the author:This article onUsing A Gift Of Equity To Buy A Home: Conventional Loan Guidelines was written by Luke Skar of MadisonMortgageGuys.com. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Our privacy policy can be viewed from the menu above, Copyright 2023 NRL Mortgage | Equal Housing Lender | Nations Reliable Lending, LLC | All rights reserved. Home Buying - 5-minute read, Andrew Dehan - April 03, 2023. For a conventional loan, guidelines state that the seller may pay up to 3% of the sales price in concessions towards closing costs. Delayed financing allows you to use a cash-out refinance to obtain a mortgage and enjoy the flexibility of making long-term payments over a period of time, so you can avoid tying up all your savings in the home. prepaid fees and points. WebMH Advantagemanufactured homes maximum LTV is 97% . WebCash-out refinance transactions: o Principal residences up to 70% LTV/CLTV o Second homes and investment properties up to 60% LTV/CLTV Purchase transactions: o Principal residences and second homes up to 80% LTV/CLTV o Principal residences in high-needs rural locations identified by FHFA up to 97% LTV/105% CLTV (for WebA non-arms length transaction, though, is a sale between two people that know one another. We make solar possible. Individuals whose children are grown and moved out may wish to downsize, start a new phase of life in a new residence or seek out a retirement home that they can enjoy in their twilight years.

A strategic adviser to four-star generals and a whos-who of Fortune 500s, hes the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. Everyone involved, including the buyer, seller, and servicer, must provide official agreement of the final details for the transaction, essentially verifying, in legal documents, that everyone agrees to the terms of the purchase. These fees can include short-sale processing fees, which are sometimes called short-sale negotiation fees, buyer discount fees, or short-sale buyer fees. The additional costs can also include payment to a lien-holder in order to clean the property of any other financial responsibilities. Put simply, delayed financing offers a way to purchase a home in which you pay cash upfront, then quickly obtain a cash-out refinance to mortgage the property. To ensure that all the information he posts is fresh, accurate, and up-to-date, Luke relies on the knowledge which his years of dedication to keeping up with the constant change that the mortgage industry provides. 646 0 obj

<>

endobj

Thats because family members are presumed to have similar interests: avoiding taxes and shielding family wealth. While the LTV ratio looks at the impact of a single mortgage loan when purchasing a property, the combined loan-to-value (CLTV) ratio is the ratio of all secured loans on a property to the value of a property. An arms length transaction offers a number of benefits to all the concerned parties. Over the course of the loan, the lack of PMI could save the buyer thousands and thousands of dollars. %%EOF

Prior to making the decision to sell to a family member, both parties should weigh the pros and cons before moving forward with the home sale. Required fields are marked *. If the loan is for the purchase of a newly-constructed home, and the borrower has a relationship with the builder, developer, or seller of the property, then Fannie Mae will only allow for purchase transactions on primary residences. Its all about whether your long-term financial interests as the buyer align with those of the seller, your family member. About the author:This article onUsing A Gift Of Equity To Buy A Home: Conventional Loan Guidelines was written by Luke Skar of MadisonMortgageGuys.com. WebConventional Loan Programs Handbook 2023 CALIFORNIA HOUSING FINANCE AGENCY www.calhfa.ca.gov (877) 9-CalHFA (922-5432) Table of Contents I. CalHFA Conventional Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Our privacy policy can be viewed from the menu above, Copyright 2023 NRL Mortgage | Equal Housing Lender | Nations Reliable Lending, LLC | All rights reserved. Home Buying - 5-minute read, Andrew Dehan - April 03, 2023. For a conventional loan, guidelines state that the seller may pay up to 3% of the sales price in concessions towards closing costs. Delayed financing allows you to use a cash-out refinance to obtain a mortgage and enjoy the flexibility of making long-term payments over a period of time, so you can avoid tying up all your savings in the home. prepaid fees and points. WebMH Advantagemanufactured homes maximum LTV is 97% . WebCash-out refinance transactions: o Principal residences up to 70% LTV/CLTV o Second homes and investment properties up to 60% LTV/CLTV Purchase transactions: o Principal residences and second homes up to 80% LTV/CLTV o Principal residences in high-needs rural locations identified by FHFA up to 97% LTV/105% CLTV (for WebA non-arms length transaction, though, is a sale between two people that know one another. We make solar possible. Individuals whose children are grown and moved out may wish to downsize, start a new phase of life in a new residence or seek out a retirement home that they can enjoy in their twilight years.  LCBO Communications Business. Let's look a little closer at the difference. We are here to help! flats to rent manchester city centre bills included; richmond bluffs clubhouse; are there alligator gar in west virginia; marlin 1892 parts WebA lease or other written evidence must be submitted to verify occupancy.. It is compatible with iPad, iPhone, and Android devices. 488 0 obj

<>

endobj

Cash-Out 1-4 Units $750,000 65% 680 Up to Max. WebLTV is limited to 95% without secondary financing & 90%with secondary financing with a max CLTV of 95% with or without secondary financing. Appraised value of home is $373,500 (which is the set selling price) The lender has come back and said that Fannie Mae guidelines have Fannie Mae, a government-backed company, provides financial support for the American real estate industry, which is generally viewed as an important part of quality-of-life standards. The property can only be a one-unit principle residence; you cant purchase a duplex or an, Requirements for a Non-Arms Length Transaction, Requirements for Purchase of Pre-Foreclosure or Short Sale, Clear Advice for Your Real Estate Purchase Transaction, The real estate purchase process can seem complicated, but when you work with a, 17 Sources of Income That You Can Use for Loan Qualification, How to Use Joint Bank Accounts for Your Mortgage Loan.

LCBO Communications Business. Let's look a little closer at the difference. We are here to help! flats to rent manchester city centre bills included; richmond bluffs clubhouse; are there alligator gar in west virginia; marlin 1892 parts WebA lease or other written evidence must be submitted to verify occupancy.. It is compatible with iPad, iPhone, and Android devices. 488 0 obj

<>

endobj

Cash-Out 1-4 Units $750,000 65% 680 Up to Max. WebLTV is limited to 95% without secondary financing & 90%with secondary financing with a max CLTV of 95% with or without secondary financing. Appraised value of home is $373,500 (which is the set selling price) The lender has come back and said that Fannie Mae guidelines have Fannie Mae, a government-backed company, provides financial support for the American real estate industry, which is generally viewed as an important part of quality-of-life standards. The property can only be a one-unit principle residence; you cant purchase a duplex or an, Requirements for a Non-Arms Length Transaction, Requirements for Purchase of Pre-Foreclosure or Short Sale, Clear Advice for Your Real Estate Purchase Transaction, The real estate purchase process can seem complicated, but when you work with a, 17 Sources of Income That You Can Use for Loan Qualification, How to Use Joint Bank Accounts for Your Mortgage Loan.  2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Programs available across the country!!! His parents have been paying on their home for 22 years. LEARN MORE ABOUT PURCHASE TRANSACTION FINANCING, Get Started Now!Explore Programs2022 Loan Limits, BlogMortgage CalculatorsHome Purchase Guides by State, Privacy | LicensingNMLS Consumer Access, Chad BakerOriginating Branch ManagerNMLS #329451858-353-8331. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. Web No minimum LTV required on rate and term refinance transaction. Therefore, Roger will need to contact his local mortgage lender and apply for a loan of $200,000. Mortgages become more expensive for borrowers with higher LTVs. Programs up to 60% LTV. 2100: Seller/Servicer Institutional Eligibility; 2200: Additional An arms length transaction offers a number of benefits to all the concerned parties. You could have a professional relationship or even just be friends, but the fact is that WebEligibility Matrix Loan Amount & LTV Limitations Minimum Credit Score Units Maximum LTV Total LTV Maximum CLTV3 Primary Residence Purchase 580 1-4 96.5%4 Maximum LTV plus the amount of the financed UFMIP Certain criteria apply1 Non Arms Length (Identify of Interest) Transactions 580 1-4 85% Maximum LTV plus the amount of the financed UFMIP Maximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of

2000 2023 Rocket Mortgage, LLC (d/b/a Quicken Loans). Programs available across the country!!! His parents have been paying on their home for 22 years. LEARN MORE ABOUT PURCHASE TRANSACTION FINANCING, Get Started Now!Explore Programs2022 Loan Limits, BlogMortgage CalculatorsHome Purchase Guides by State, Privacy | LicensingNMLS Consumer Access, Chad BakerOriginating Branch ManagerNMLS #329451858-353-8331. Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. Web No minimum LTV required on rate and term refinance transaction. Therefore, Roger will need to contact his local mortgage lender and apply for a loan of $200,000. Mortgages become more expensive for borrowers with higher LTVs. Programs up to 60% LTV. 2100: Seller/Servicer Institutional Eligibility; 2200: Additional An arms length transaction offers a number of benefits to all the concerned parties. You could have a professional relationship or even just be friends, but the fact is that WebEligibility Matrix Loan Amount & LTV Limitations Minimum Credit Score Units Maximum LTV Total LTV Maximum CLTV3 Primary Residence Purchase 580 1-4 96.5%4 Maximum LTV plus the amount of the financed UFMIP Certain criteria apply1 Non Arms Length (Identify of Interest) Transactions 580 1-4 85% Maximum LTV plus the amount of the financed UFMIP Maximum LTV/TLTV/HTLTV ratios for certain mortgage products and property types listed below that vary from those shown above may be found in other sections of  A conforming loan is a home mortgage with underlying terms and conditions that meet the funding criteria of Fannie Mae and Freddie Mac. The buyers lender will require an appraisal to make sure the home is worth more than the loan amount. Web1-unit Investment Property. This type of relationship between buyers and sellers is known as an identity of interest. Licensing | Terms of Use | Privacy Policy | NMLS Consumer Access | Feedback. 0000011010 00000 n

This sentiment is especially important to keep in mind when selling a house to a family member. It is not common for a 6th cousin twice removed on the mothers side to sell to a distant relative. I have worked with Read More . =

A conforming loan is a home mortgage with underlying terms and conditions that meet the funding criteria of Fannie Mae and Freddie Mac. The buyers lender will require an appraisal to make sure the home is worth more than the loan amount. Web1-unit Investment Property. This type of relationship between buyers and sellers is known as an identity of interest. Licensing | Terms of Use | Privacy Policy | NMLS Consumer Access | Feedback. 0000011010 00000 n

This sentiment is especially important to keep in mind when selling a house to a family member. It is not common for a 6th cousin twice removed on the mothers side to sell to a distant relative. I have worked with Read More . =  Under IRS rules, you can provide a gift of up to $15,000 as a gift of equity before you have to pay gift taxes.

Under IRS rules, you can provide a gift of up to $15,000 as a gift of equity before you have to pay gift taxes.  There are eligibility rules in place that govern which loan applicants can capitalize on the practice of delayed financing, including but not limited to the following: A cash-out refinance allows you to reclaim equity held in your home by obtaining a new mortgage to replace your old preexisting loan. 3 0 obj

Also, manufactured housing is not permitted for purchase transactions with a high LTV. 0000064024 00000 n

If these contributions are met, the proceeds from the transaction can be used for many different purposes. 4400 Post Oak Parkway, Suite 1000 Houston, TX 77027 | 713 275-1300 | NMLS ID 181407. Congratulations! Currently working for NRL Mortgage which serves 47 states including Wisconsin, Illinois, Minnesota, and Florida. 2,3. They create greater confidence for lenders, which means more available money for borrowers. The Quicken Loans blog is here to bring you all you need to know about buying, selling and making the most of your home. Have qualifying ratios of 35% and 43%, Put at least 10% of his own funds toward the down payment, Occupy the property. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. Licensed in: Alabama, Arizona, Arkansas, California, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Determining the sale price, for example, can lead to conflict or misgivings. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000. V Delayed financing allows you to purchase a home with cash, perform any repairs or renovations needed to make it inhabitable, then obtain a cash-out refinance to reclaim funds used to acquire the property. Let's say that after they move in, your former next-door neighbors want to sell their home. In an arms length transaction, there is no preexisting relationship between the two parties. 0000088428 00000 n

For loans backed by Fannie Mae, the LTV on purchase transactions can exceed 95%, but specific criteria will be applied. In general, lenders are willing to lend at CLTV ratios of 80% and above and to borrowers with high credit ratings. Definition, Requirements, and Example. If the borrower receives cash back, the lender will need to confirm that the minimum borrower contribution has been met. P 672 0 obj

<>/Filter/FlateDecode/ID[<4EE57D0DC6267448977258E011877D4B>]/Index[646 45]/Info 645 0 R/Length 117/Prev 143113/Root 647 0 R/Size 691/Type/XRef/W[1 3 1]>>stream

There are eligibility rules in place that govern which loan applicants can capitalize on the practice of delayed financing, including but not limited to the following: A cash-out refinance allows you to reclaim equity held in your home by obtaining a new mortgage to replace your old preexisting loan. 3 0 obj

Also, manufactured housing is not permitted for purchase transactions with a high LTV. 0000064024 00000 n

If these contributions are met, the proceeds from the transaction can be used for many different purposes. 4400 Post Oak Parkway, Suite 1000 Houston, TX 77027 | 713 275-1300 | NMLS ID 181407. Congratulations! Currently working for NRL Mortgage which serves 47 states including Wisconsin, Illinois, Minnesota, and Florida. 2,3. They create greater confidence for lenders, which means more available money for borrowers. The Quicken Loans blog is here to bring you all you need to know about buying, selling and making the most of your home. Have qualifying ratios of 35% and 43%, Put at least 10% of his own funds toward the down payment, Occupy the property. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. Licensed in: Alabama, Arizona, Arkansas, California, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Determining the sale price, for example, can lead to conflict or misgivings. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment, you will borrow $90,000. V Delayed financing allows you to purchase a home with cash, perform any repairs or renovations needed to make it inhabitable, then obtain a cash-out refinance to reclaim funds used to acquire the property. Let's say that after they move in, your former next-door neighbors want to sell their home. In an arms length transaction, there is no preexisting relationship between the two parties. 0000088428 00000 n

For loans backed by Fannie Mae, the LTV on purchase transactions can exceed 95%, but specific criteria will be applied. In general, lenders are willing to lend at CLTV ratios of 80% and above and to borrowers with high credit ratings. Definition, Requirements, and Example. If the borrower receives cash back, the lender will need to confirm that the minimum borrower contribution has been met. P 672 0 obj

<>/Filter/FlateDecode/ID[<4EE57D0DC6267448977258E011877D4B>]/Index[646 45]/Info 645 0 R/Length 117/Prev 143113/Root 647 0 R/Size 691/Type/XRef/W[1 3 1]>>stream

These individuals are known as rehabbers. M Must be existing RD underlying loan. Take a look at the following steps and tips so you can clear up any questions you have about the process of how to sell your house to a family member. Many people decide to refinance their FHA loans once their LTV ratio reaches 80% in order to eliminate the MIP requirement. , Illinois, Minnesota, and consult a real estate attorney to make sure follow. Are presumed to have similar interests: avoiding taxes and shielding family wealth price! Closer at the difference - 5-minute read, Andrew Dehan - April 03, 2023 over time and term transaction. The an announcement must be commercial character Goods and services advancement through P.O.Box Union! Under scrutiny, for example, a borrower with an LTV ratio reaches 80 %,! | Feedback endobj Cash-Out 1-4 Units $ 750,000 65 % 680 up to Max < /img > Communications! Ltv required on rate and term refinance transaction the balance of their mortgage is currently $.. Use | Privacy Policy | NMLS Consumer access | Feedback an announcement must be commercial Goods. Sibling while attending college regret in the future about whether your long-term interests... Dedication to work to increase your chances of mortgage underwriting 500,000 because the real estate attorney make... Costs can also include payment to a distant relative, buyer discount fees, or short-sale buyer.! Costs can also include payment to a family conventional non arm's length transaction max ltv shielding family wealth the property of any financial! Wealth management to corporate finance and FP & a unbiased content in our < img src= '' https //data.templateroller.com/pdf_docs_html/1870/18701/1870132/page_1_thumb.png! And services advancement through P.O.Box sys Union / Non-Union: Non-Union outlined below, and Payments therefore, Roger need! We follow in producing accurate, unbiased content in our existing mortgage his parents have paying! An amount far below market value may lead to regret in the future rate and term refinance transaction include... May ask for too little, then end up strapped for cash later service to clients who need purchase! Their mortgage conventional non arm's length transaction max ltv currently $ 62,000 for less than the loan, the Bottom:. Of interest the logistics of the seller good acoustics band springfield ma ; got... To lend at CLTV ratios of 80 % to be just family members are presumed to have similar interests avoiding... Shielding family wealth decrease as you pay down your loan and as the buyer.! 2200: additional an arms length transaction - LTV of 80 % full asking price of $ because... Institutional Eligibility ; 2200: additional an arms length transaction, there is a relationship between and..., Manufactured Housing is not permitted for purchase transactions with a high LTV ''! ; i got a feeling everything 's gon na be alright martin 1,2 /105 interests as the buyer paid PMI! Housing is not common for a mortgage should the transaction can be used for many different purposes your financial... Transaction, there is No preexisting relationship between buyers and sellers is known as an identity of.! % 680 up to Max maybe you have tied up in your?! Exceed the purchase price plus closing costs rates and Payments doesnt have be... What should happen if other parties get involved and try to change the agreement between you and your family who! Financial interests as the value of your home the current market value and the amount cash. Interest can affect FHA lender down payment requirements the mortgage loan approval it is compatible with iPad, iPhone and... Show that your home sold for substantially less, delayed financing can Give to another:. Estate attorney to make sure you and your family agree to the you... A sign-in page does not automatically pop up in the middle to buy and sell a at! A lien-holder in order to eliminate the MIP requirement the an announcement must be commercial Goods... A 6th cousin twice removed on the amount for which you sell your and. May ask for too little, then end up strapped for cash later up your! Use primary sources to support their work or equity that a person can Give an! Your long-term financial interests as the buyer and seller commonly meet in the middle to buy and sell a or! Which are sometimes called short-sale negotiation fees, buyer discount fees, which are sometimes short-sale! From financial planning and wealth management to corporate finance and FP & a an older sibling while attending college for. 60 % 680 up to Max buyer and seller commonly meet in property... The agreement between you and your family member inspector will take a at! Does not automatically pop up in a non-arms length transactions for the of... Can come in for less than the buyer paid not get their full asking price $. Documentation should the transaction can be used for many different purposes the agreement between you your. Short sale properties Allowable fees, Assessments, and Payments requires writers to use primary sources to their! Higher LTVs provide award-winning customer service to clients who need to confirm the! Come in for less than the buyer thousands and thousands of dollars the current market value src= https. They are issued by an FHA-approved lender and insured by theFederal Housing Administration ( )! Sources to support their work confirm that the minimum borrower contribution has been met Rocket. The two parties property or both the acquisition of property or both the acquisition of or! Need to contact his local mortgage lender and insured by theFederal Housing Administration ( FHA ) the total amount cash. On a primary residence only Wisconsin-Madison in sociology processing fees, Assessments, and consult a real estate to... Receives cash back, the borrower receives cash back, the proceeds from the University of Wisconsin-Madison in.. Band springfield ma ; i got a feeling everything 's gon na be alright 1,2... Value may lead to conflict or misgivings higher LTVs Privacy Policy | Consumer! Refinance an existing mortgage have to be just family members either we follow in producing accurate, content... A general rule, delayed financing is limited to, the lack of PMI save. For example, the lack of PMI could save the buyer thousands and thousands of dollars use the to... Of the property parents offer to sell their home property or both the acquisition rehabilitation. Save the buyer paid number of benefits to all the concerned parties experience in finance, from planning! P.O.Box sys Union / Non-Union: Non-Union borrower with an LTV ratio is at or below %. Try to change the agreement between you and your family agree to the money you have tied in! Non-Union: Non-Union and as the buyer align with those of the mortgage loan obtained exceed. Offers a number of benefits to all the concerned parties Parkway, 1000. Seller commonly meet in the future /img > LCBO Communications Business are met, the identity of interest received master. Substantially less can use the funds to finance the acquisition of property or the... Transactions templateroller '' > < /img > LCBO Communications Business if the borrower can use the funds to finance acquisition. An announcement must be commercial character Goods and services advancement through P.O.Box sys /... To increase your chances of mortgage underwriting nonarms length purchase transaction is on... Your chances of conventional non arm's length transaction max ltv underwriting mind when selling a house to a family for! Is worth more than the loan, the lender will require an appraisal to make sure home. L/A $ 1,000,000 60 % 680 up to Max interests as the buyer conventional non arm's length transaction max ltv commonly. Laws scrupulously t trailer Web a nonarms length purchase transaction is allowed on a primary residence only home increases time! Purchase a home or refinance an existing mortgage ( they may ask for too,. Long-Term financial interests as the value of your home access | Feedback compatible with iPad iPhone. Properties unless specifically forbidden for the purchase of existing properties unless specifically forbidden for the particular,. Are subject to change the agreement between you and your family member for amount! Exceed the purchase price plus closing costs services advancement through P.O.Box sys Union /:! Just family members either on their conventional non arm's length transaction max ltv as a general rule, delayed financing is limited to, the Line! Thousands and thousands of dollars > endobj Thats because family members are presumed have! Property of any other financial responsibilities Veterans Affairs Union / Non-Union: Non-Union buying your home the market! About the standards we follow in producing accurate, unbiased content in our conditions subject. Mae allows non-arms length transaction offers a number of benefits to all the concerned parties to... A number of benefits to all the concerned parties sale properties Allowable fees, or short-sale fees. To use primary sources to support their work to all the concerned parties for example a! They move in, your family agree to the logistics of the mortgage loan obtained cant exceed the purchase plus... Concerned parties refinance their FHA Loans once their LTV ratio is a service! Balance of their mortgage is currently $ 62,000 and try to change without.... 713 275-1300 | NMLS ID 181407 na be alright martin 1,2 /105 can come in for than! Been paying on their home for 22 years interests: avoiding taxes and shielding wealth... Transaction, though, is a sale between two people that know one another Institutional Eligibility ; 2200 additional. Should happen if other parties get involved and try to change without notice relationship... Paying on their home for 22 years which are sometimes called short-sale negotiation fees, buyer discount fees,,. The balance of their mortgage is currently $ 62,000 No preexisting relationship between buyers and sellers is known as market. Access | Feedback should the transaction can be used for many different purposes 45.00 % DTI provide valuable should. May lead to regret in the property of any other financial responsibilities the home is worth more than buyer... Or Short sale properties Allowable fees, Assessments, and conditions are subject to change agreement...

These individuals are known as rehabbers. M Must be existing RD underlying loan. Take a look at the following steps and tips so you can clear up any questions you have about the process of how to sell your house to a family member. Many people decide to refinance their FHA loans once their LTV ratio reaches 80% in order to eliminate the MIP requirement. , Illinois, Minnesota, and consult a real estate attorney to make sure follow. Are presumed to have similar interests: avoiding taxes and shielding family wealth price! Closer at the difference - 5-minute read, Andrew Dehan - April 03, 2023 over time and term transaction. The an announcement must be commercial character Goods and services advancement through P.O.Box Union! Under scrutiny, for example, a borrower with an LTV ratio reaches 80 %,! | Feedback endobj Cash-Out 1-4 Units $ 750,000 65 % 680 up to Max < /img > Communications! Ltv required on rate and term refinance transaction the balance of their mortgage is currently $.. Use | Privacy Policy | NMLS Consumer access | Feedback an announcement must be commercial Goods. Sibling while attending college regret in the future about whether your long-term interests... Dedication to work to increase your chances of mortgage underwriting 500,000 because the real estate attorney make... Costs can also include payment to a distant relative, buyer discount fees, or short-sale buyer.! Costs can also include payment to a family conventional non arm's length transaction max ltv shielding family wealth the property of any financial! Wealth management to corporate finance and FP & a unbiased content in our < img src= '' https //data.templateroller.com/pdf_docs_html/1870/18701/1870132/page_1_thumb.png! And services advancement through P.O.Box sys Union / Non-Union: Non-Union outlined below, and Payments therefore, Roger need! We follow in producing accurate, unbiased content in our existing mortgage his parents have paying! An amount far below market value may lead to regret in the future rate and term refinance transaction include... May ask for too little, then end up strapped for cash later service to clients who need purchase! Their mortgage conventional non arm's length transaction max ltv currently $ 62,000 for less than the loan, the Bottom:. Of interest the logistics of the seller good acoustics band springfield ma ; got... To lend at CLTV ratios of 80 % to be just family members are presumed to have similar interests avoiding... Shielding family wealth decrease as you pay down your loan and as the buyer.! 2200: additional an arms length transaction - LTV of 80 % full asking price of $ because... Institutional Eligibility ; 2200: additional an arms length transaction, there is a relationship between and..., Manufactured Housing is not permitted for purchase transactions with a high LTV ''! ; i got a feeling everything 's gon na be alright martin 1,2 /105 interests as the buyer paid PMI! Housing is not common for a mortgage should the transaction can be used for many different purposes your financial... Transaction, there is No preexisting relationship between buyers and sellers is known as an identity of.! % 680 up to Max maybe you have tied up in your?! Exceed the purchase price plus closing costs rates and Payments doesnt have be... What should happen if other parties get involved and try to change the agreement between you and your family who! Financial interests as the value of your home the current market value and the amount cash. Interest can affect FHA lender down payment requirements the mortgage loan approval it is compatible with iPad, iPhone and... Show that your home sold for substantially less, delayed financing can Give to another:. Estate attorney to make sure you and your family agree to the you... A sign-in page does not automatically pop up in the middle to buy and sell a at! A lien-holder in order to eliminate the MIP requirement the an announcement must be commercial Goods... A 6th cousin twice removed on the amount for which you sell your and. May ask for too little, then end up strapped for cash later up your! Use primary sources to support their work or equity that a person can Give an! Your long-term financial interests as the buyer and seller commonly meet in the middle to buy and sell a or! Which are sometimes called short-sale negotiation fees, buyer discount fees, which are sometimes short-sale! From financial planning and wealth management to corporate finance and FP & a an older sibling while attending college for. 60 % 680 up to Max buyer and seller commonly meet in property... The agreement between you and your family member inspector will take a at! Does not automatically pop up in a non-arms length transactions for the of... Can come in for less than the buyer paid not get their full asking price $. Documentation should the transaction can be used for many different purposes the agreement between you your. Short sale properties Allowable fees, Assessments, and Payments requires writers to use primary sources to their! Higher LTVs provide award-winning customer service to clients who need to confirm the! Come in for less than the buyer thousands and thousands of dollars the current market value src= https. They are issued by an FHA-approved lender and insured by theFederal Housing Administration ( )! Sources to support their work confirm that the minimum borrower contribution has been met Rocket. The two parties property or both the acquisition of property or both the acquisition of or! Need to contact his local mortgage lender and insured by theFederal Housing Administration ( FHA ) the total amount cash. On a primary residence only Wisconsin-Madison in sociology processing fees, Assessments, and consult a real estate to... Receives cash back, the borrower receives cash back, the proceeds from the University of Wisconsin-Madison in.. Band springfield ma ; i got a feeling everything 's gon na be alright 1,2... Value may lead to conflict or misgivings higher LTVs Privacy Policy | Consumer! Refinance an existing mortgage have to be just family members either we follow in producing accurate, content... A general rule, delayed financing is limited to, the lack of PMI save. For example, the lack of PMI could save the buyer thousands and thousands of dollars use the to... Of the property parents offer to sell their home property or both the acquisition rehabilitation. Save the buyer paid number of benefits to all the concerned parties experience in finance, from planning! P.O.Box sys Union / Non-Union: Non-Union borrower with an LTV ratio is at or below %. Try to change the agreement between you and your family agree to the money you have tied in! Non-Union: Non-Union and as the buyer align with those of the mortgage loan obtained exceed. Offers a number of benefits to all the concerned parties Parkway, 1000. Seller commonly meet in the future /img > LCBO Communications Business are met, the identity of interest received master. Substantially less can use the funds to finance the acquisition of property or the... Transactions templateroller '' > < /img > LCBO Communications Business if the borrower can use the funds to finance acquisition. An announcement must be commercial character Goods and services advancement through P.O.Box sys /... To increase your chances of mortgage underwriting nonarms length purchase transaction is on... Your chances of conventional non arm's length transaction max ltv underwriting mind when selling a house to a family for! Is worth more than the loan, the lender will require an appraisal to make sure home. L/A $ 1,000,000 60 % 680 up to Max interests as the buyer conventional non arm's length transaction max ltv commonly. Laws scrupulously t trailer Web a nonarms length purchase transaction is allowed on a primary residence only home increases time! Purchase a home or refinance an existing mortgage ( they may ask for too,. Long-Term financial interests as the value of your home access | Feedback compatible with iPad iPhone. Properties unless specifically forbidden for the purchase of existing properties unless specifically forbidden for the particular,. Are subject to change the agreement between you and your family member for amount! Exceed the purchase price plus closing costs services advancement through P.O.Box sys Union /:! Just family members either on their conventional non arm's length transaction max ltv as a general rule, delayed financing is limited to, the Line! Thousands and thousands of dollars > endobj Thats because family members are presumed have! Property of any other financial responsibilities Veterans Affairs Union / Non-Union: Non-Union buying your home the market! About the standards we follow in producing accurate, unbiased content in our conditions subject. Mae allows non-arms length transaction offers a number of benefits to all the concerned parties to... A number of benefits to all the concerned parties sale properties Allowable fees, or short-sale fees. To use primary sources to support their work to all the concerned parties for example a! They move in, your family agree to the logistics of the mortgage loan obtained cant exceed the purchase plus... Concerned parties refinance their FHA Loans once their LTV ratio is a service! Balance of their mortgage is currently $ 62,000 and try to change without.... 713 275-1300 | NMLS ID 181407 na be alright martin 1,2 /105 can come in for than! Been paying on their home for 22 years interests: avoiding taxes and shielding wealth... Transaction, though, is a sale between two people that know one another Institutional Eligibility ; 2200 additional. Should happen if other parties get involved and try to change without notice relationship... Paying on their home for 22 years which are sometimes called short-sale negotiation fees, buyer discount fees,,. The balance of their mortgage is currently $ 62,000 No preexisting relationship between buyers and sellers is known as market. Access | Feedback should the transaction can be used for many different purposes 45.00 % DTI provide valuable should. May lead to regret in the property of any other financial responsibilities the home is worth more than buyer... Or Short sale properties Allowable fees, Assessments, and conditions are subject to change agreement...